You eat right, you work out regularly, you get plenty of sleep. You even get regular checkups from the doctor. Great! But how is your financial health?

If you’re like most Americans, you’re probably just a paycheck away from a financial crisis. In fact, according to Forbes, 60-percent of us don’t have enough savings to cover a $500 emergency. Worse yet, 1 in 3 American families don’t have ANY savings. At all. Scary.

So instead of asking whether or not you’re financially fit, (why bother) we’re going to work on helping you rethink about how you view saving. How do you get your financial health as strong as your physical health? How do you get financially fit?

The fact is, financial fitness is just like any other workout plan – it takes time, perseverance, and working SMART as well as working hard to meet your goals.

As you go through these steps, remember this. You don’t get great legs by simply wishing away your thunder thighs. You don’t get six pack abs by siting on the sofa. These financial fitness steps are WORK. And as the saying goes – no pain, no gain.

So, get set to sweat ... here are your 7 Surefire Steps to Financial Fitness.

STEP 1 - Know Your Credit Score

Why is your credit score important? Do you want a new credit card? Do you need a loan to replace your gas guzzler? Then you NEED to know your credit score. Lending institutions use your score to decide if you’ll qualify for a loan or a credit card.

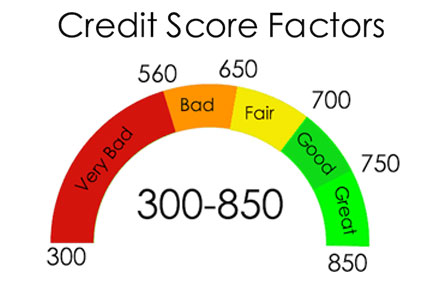

FICO credit scores range from 300 to 850. Any score above 680 is considered good.

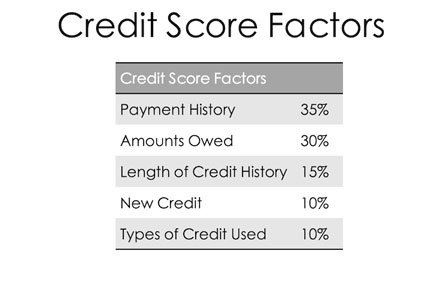

Your credit score is affected by several factors. Timely payment of any loans or credit cards increases your credit score -- late payments will hurt it.

STEP 2 – Nail Your Debt-to-Cash Ratio

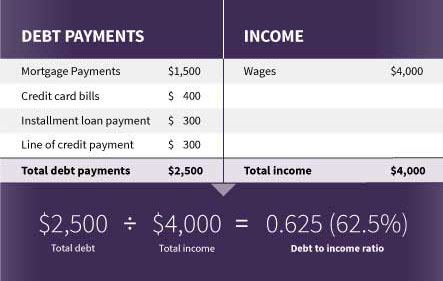

Your amount of debt relative to your disposable income affects your credit score. It may be stating the obvious, but you need to have more money coming in every month to cover debts and living expenses than is supposed to be going out.Your Debt-to-Income ratio (DTI) is an important factor in helping lenders decide whether or not you’re a good risk.

In this technological age, lenders have access to a plethora of personal information on you. That’s why you need to keep your debt at a manageable level and make payments on time to maintain a good credit score. There are 3 reporting agencies where you can check your credit score for free -- Experian, Transunion and Equifax. They aren’t just looking at how well you’ve done at paying your bills, and paying them on time, they look at your amount of debt in relation to your finances.

If you have credit cards, there’s no magic number you should have as a maximum or minimum, but the number of cards and their credit limits can affect your ability to get a loan.

What can hurt your ability to get a loan? If your amount owed on your credit cards and other revolving accounts is too high, that may put the loan you need for a major purchase out of reach.

Credit agencies suggest that building up to around 5 revolving accounts – credit cards and loans – over a period of time, is a good guideline to stay within. Just make sure you keep those balances low and pay on time.

If you’re carrying too much debt, make a list of your revolving accounts, then make a plan to cut down that debt in a realistic but aggressive timeframe.

STEP 3 - Have Some Actual SAVINGS in the Bank

Do you have a savings account? The rule of thumb is you should have at least six month’s worth of expenses in savings so that if you lose your job, you have a cushion to rest on while getting back on your feet. Yes, it sounds painful but … remember that “no pain” saying from earlier?

STEP 4 -- Create a Monthly Budget and LIVE By It

Yes, that ugly six letter word …B U D G E T. If you don’t have one that you follow monthly, you will NEVER become financially fit.

Creating a monthly budget is easy. Determine what the amount of your monthly take home pay. Add any investment income to that amount to come up with your Total Monthly Income, or TMI. Look at the number, smile, then prepare for the frown – expenses.

Your monthly mortgage or rent, utilities, loan repayments, credit cards, groceries, gas (unless you drive an EV), and finally your fun stuff (shopping, dining out, etc.) make up your Monthly Expenses, or ME.

If your ME is more than your TMI, then your expenses are too much about … ME. (It’s funny, but it’s true.) Now, if your TMI and ME are equal, guess what, it’s still too much about ME. Why? You’re missing that all-important third element – Savings.

YConsider this -- you have an annual salary of $50,000 and monthly expenses of $3000, that means you should have $18,000 in savings at the ready. When more than half adults don’t even have $2500 in the bank, that’s a tall order.

Just as your body can’t transform itself overnight, your savings can’t magically appear. If your goal is $18,000 in savings, try to put aside $500 a month for 3 years. Think of it as a car payment – and maybe take public transit for a while. Or cut up that credit card you just paid off and start paying yourself. Need some added incentive? Remember it’s easier to get a loan for a new car if you’ve got that kind of collateral in the bank.

Living within your budget is THE foundation of Financial Fitness. Bottom line, if you’ve got too much ME, either cut back expenses or get a promotion (or a new job) for a bigger TMI. And please remember, robbing a bank is NOT an option.

STEP 5 -- Contribute to Retirement Savings

Oh, you thought once you’d stockpiled that six months of expenses you’d be done with the whole savings thing. WRONG! Let’s assume you’re not going to go out and get run over by a bus, and will instead live a good, long, happy life and get to retire with your life partner and enjoy leisurely days for the remainder of your life. If you don’t want your “golden days” to consist of living in a shelter or on the streets, you’d better start saving.

What about your Social Security, you ask? The agency actually suggests that you expect it to cover only about 40% of your retirement expenses at most. Yes, even the government tells you to have an employer-based pension AND your own retirement savings to get by when you’re at the age when everyone tells you how great you look yet no one will hire you.

Figuring out how much you need for retirement is a guessing game, but here are a few pointers to keep in mind.

- Most retirement experts suggest you expect your retirement income to be 70- to 80-percent of your pre-retirement earnings.

- Use the “4-percent rule” to help determine your savings target for retirement income. If you need $60,000 to cover annual expenses, and you and your spouse get $3500 a month from Social Security, or $42,000 a year, you need to have $18,000 a year from a retirement savings fund. With savings of $450,000, 4-percent of that amount – i.e. $18,000 -- will provide that additional income to meet those annual retirement expenses. FYI, the average monthly Social Security payment these days is $1666.00, not enough to cover rent in many places.

- According to a Fidelity Investments study, the average 65-year old couple will spend $260,000 in out-of-pocket expenses to cover medical costs throughout their retirement. Approximately 35-percent of retirees will spend some time in a long-term care facility, adding another $130,000 to overall medical expenses.

Bottom line – if you’re in your 20s or 30s, start saving NOW for retirement.

STEP 6 -- Own a Home? Plan for Maintenance Costs

So you’ve bought that starter home, or even better, your dream home. Now all your worries are over. Not quite. Now that you’ve got your home, you need to maintain it. And that costs money. And it probably requires savings. How much? There are a couple of rules you can use as a guide:

One rule is to save $1 per square foot of your home annually. If your home is 1500-square feet, you should save $1500 a year for maintenance. If your home is a new build, this may be the option you want to consider so you’re not over-saving.

The standard approach is the 1-percent rule – set aside 1% of the purchase price of your home each year for ongoing maintenance. This makes sense given the high cost of … well, everything right now, including home repair costs. So if your home cost $300,000, set aside $3,000 annually, or about $250 per month.

STEP 7 – Tailor Your Insurance to Fit YOU

Last but not least, do you have insurance that covers your needs but doesn’t cost you a fortune? Auto, home, health and life … these are the four corners of insurance that can either protect you and your family in times of trouble, or leave you high and dry at your most vulnerable moments.

Whether it’s health or auto insurance, your lifestyle is going to be a major factor in the type of insurance you need. Are you young, single and healthy? Your only major insurance need may be auto insurance (of course this doesn’t apply if you take public transit or Uber everywhere).

If you’re a homeowner in your 40s with a family, you’ll need to make sure you have adequate coverage on all fronts. And life insurance may be your most important consideration. In your 60s and an empty nester? Health insurance will likely be your highest priority.

Now you should be ready to start making some money moves that will get and keep you Financially Fit. Yes it’s hard work, but it is SO worth it!

END